Ermenegildo Zegna (ZGN)·Q4 2025 Earnings Summary

Zegna Q4 2025: DTC Drives Organic Acceleration as Leadership Transition Unfolds

February 2, 2026 · by Fintool AI Agent

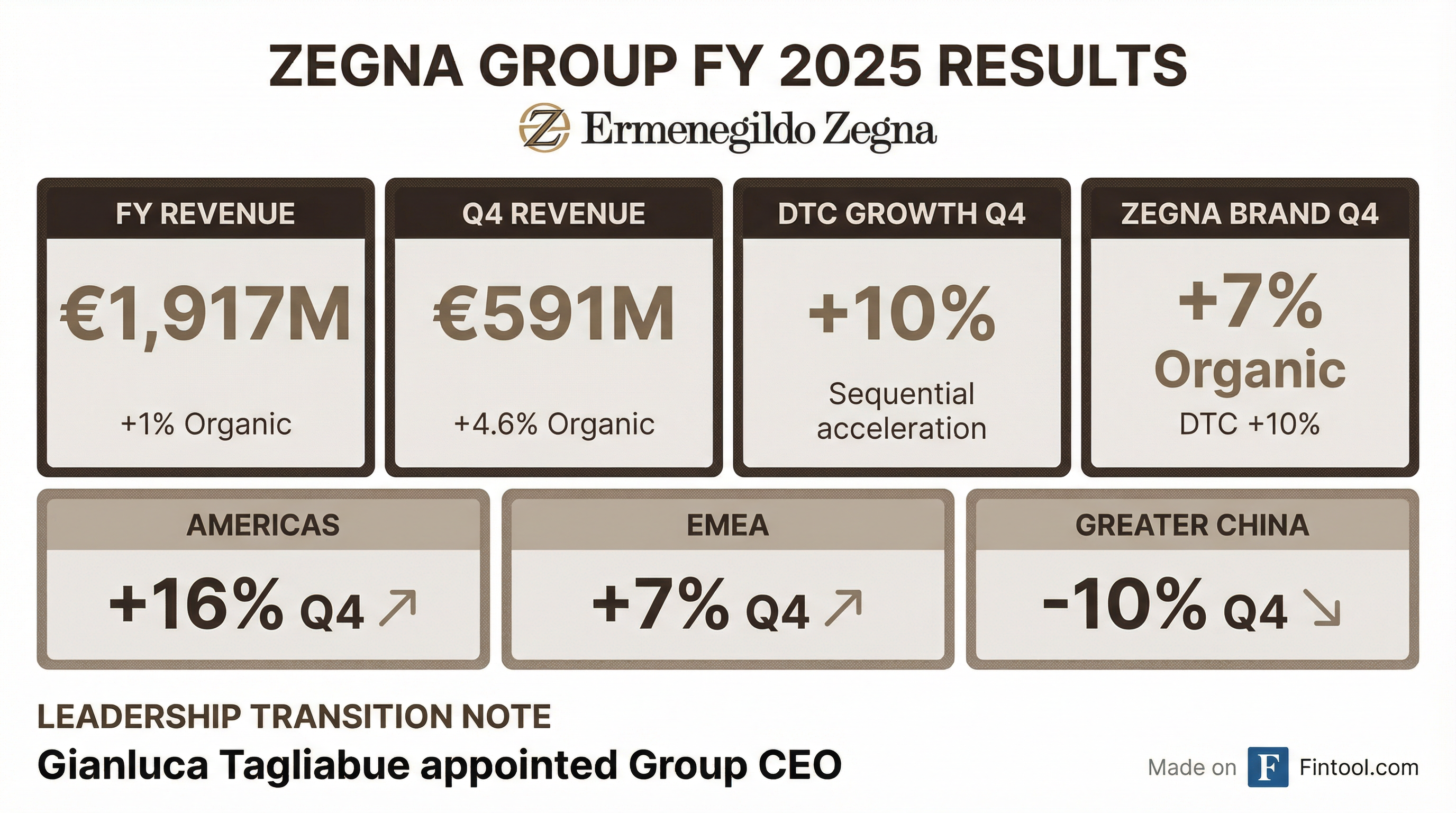

Ermenegildo Zegna Group (NYSE: ZGN) reported preliminary FY 2025 revenues of €1,917 million, up +1% organic year-over-year, with Q4 revenue of €591 million showing meaningful acceleration at +4.6% organic . The results come alongside a significant leadership transition, with Gianluca Tagliabue appointed as Group CEO and Edoardo and Angelo Zegna named Co-CEOs of the Zegna brand .

The flagship ZEGNA brand was the standout, posting +7% organic growth in Q4 with DTC up 10% . Executive Chairman Gildo Zegna emphasized the company's differentiated positioning: "Looking to the year ahead, I believe we all face a new normal—a world more uncertain and less predictable. In this context, agility, coherence, vision, speed, together with talents, will make the difference" .

Did Zegna's Revenue Growth Accelerate?

Yes—and meaningfully. Q4 organic growth of +4.6% represents the strongest quarter of 2025:

The acceleration was driven by the DTC channel delivering +10% organic growth in Q4, a sequential improvement from +9% in Q3 .

How Did Each Brand Perform?

ZEGNA Brand (€1.2B FY Revenue)

The core ZEGNA brand reached €362M in Q4 (+7% organic) with DTC growing +10% organic . Americas and EMEA both delivered solid double-digit growth, while Greater China remained negative but showed improved trends versus Q3 .

Key metric: ZEGNA DTC now represents 88% of brand revenues for FY 2025, up from prior periods .

Wholesale declined -17% in Q4 as management continues deliberate actions to rationalize distribution .

Thom Browne (€91M Q4 Revenue)

Thom Browne reported +1.4% organic in Q4, supported by DTC growth of +11% driven by Americas and Japan, with new store openings (New York Madison Avenue, LA Melrose, Palm Beach, Tokyo Ginza) . Wholesale declined -14% in Q4 and -40% for the full year as the brand transitions to a retail-first organization under CEO Sam Lobban .

Tom Ford Fashion (€98M Q4 Revenue)

Tom Ford Fashion posted +1.5% organic in Q4 with DTC growing +5% . Management noted the brand has started 2026 positively, benefiting from strong reception of the Spring collection designed by Haider Ackermann .

What Changed Regionally?

All key regions accelerated in Q4 versus Q3 2025, with Americas continuing to outperform:

Management noted that Greater China's share has been halved since IPO in 2021, when it was ~46% of revenues .

What Did Management Say About 2026?

FX Headwind and Margin Outlook

CEO Tagliabue provided clear guidance on expectations:

"We are seeing something similar for the year [~2.6% FX headwind]. Part of that can be mitigated by hedging... but there will definitely be an impact from currency. That's why I think margin in 2026 will be moving sideways."

Pricing strategy: Mid-single-digit price increases in Spring and Fall 2026 to offset currency, not repricing for margin expansion .

January 2026 Trends

On early 2026 performance (adjusting for Chinese New Year timing shift):

"If we isolate the effect of the calendar of Chinese New Year, we don't see a trend significantly different in DTC from the one of Q4 2025... America keeps being our number one market in terms of percentage growth, followed by the Gulf area. Europe is doing pretty well."

Wholesale Outlook

Wholesale expected to decline high single-digit at group level in 2026, with Thom Browne seeing low double-digit negative and ZEGNA in the low single-digit negative range .

What's the Saks Global Exposure?

Saks Global filed for Chapter 11 bankruptcy on January 13, 2026. Management addressed exposure directly:

"Saks Global in the different dimensions—Saks, Neiman, and BGs—represents a low single-digit incidence on our group's revenues. So that's why we face the situation looking forward with optimism that we can offset the impacts."

Key points:

- Exposure is primarily a credit/receivables issue, not inventory

- Bad debt accrual outcome still uncertain pending negotiations

- Full EBIT consensus (~€173M for FY 2025) is reasonable before Saks accruals

What's Driving High-End Customer Spending?

The Zegna Friends program (clients spending EUR 50,000+ annually) continues to drive growth:

"We see extremely good momentum on clients above EUR 25,000 spending... and also the ones above EUR 50,000. Those clusters—25 to 50 and 50 and above—are the ones driving growth on the Zegna brand."

Villa Zegna concept: Management highlighted the experiential retail format as a key differentiator:

"More and more customers are embracing this project because it's about experience. It's not about selling because most of the product you can find in Villa Zegna, you cannot find in the store... The level of service, surprises, experiences, the level of product innovation created by Alessandro Sartori are quite unique."

Villa Zegna locations planned for several additional destinations in 2026, complementing new store openings .

What's the Store Development Plan?

2026 Openings (confirmed):

China rationalization: Approximately 10 ZEGNA stores to close over the medium term as management concentrates business in fewer, better locations .

Tom Ford target: Currently 60-70 doors, targeting 100 stores in the mid-term .

How Did the Stock React?

ZGN shares traded down -2.8% following the results release, closing at $8.69 on January 30, 2026. In aftermarket trading following the call, shares rose to $8.89 (+2.3%).

The stock remains below both moving averages, reflecting broader luxury sector concerns around China and currency headwinds.

Key Q&A Highlights

On ZEGNA brand ex-China growth: Analyst calculations confirmed ZEGNA DTC ex-China grew approximately high teens in Q4 .

On productivity drivers: Mix and price driving growth, with elevated offerings like Triple Stitch NAM version and Vellus Aureum collection expansion. Triple Stitch represents ~15% of ZEGNA revenues .

On Hong Kong: Slight improvement seen versus mainland China .

On personalization advantage: The Zegna Filiera (vertical supply chain) enables personalization capabilities that management plans to extend to Tom Ford and Thom Browne .

What Should Investors Watch Next?

Key dates:

- March 20, 2026: FY 2025 Full Financial Results (margins, P&L, Saks accruals)

- April 30, 2026: Q1 2026 Revenues

Questions for the full results call:

- Saks accrual: What's the final bad debt provision?

- Margin detail: How did gross margin vs OPEX evolve with DTC mix shift?

- China trajectory: Is Q4's sequential improvement sustainable?

- Tom Ford path to profitability: When does EBIT turn positive?

- Thom Browne inflection: When does like-for-like DTC growth accelerate?

Key Takeaways

Positives:

- Q4 organic growth accelerated to +4.6%, best quarter of the year

- ZEGNA brand momentum strong at +7% organic with DTC +10%

- Americas delivered +16% organic growth in Q4

- DTC mix now 82% of branded sales

- January trends similar to Q4 outside Chinese New Year timing

- Saks exposure manageable at low single-digit %

Concerns:

- Greater China still declining at -10% organic

- 2026 margin expected to move sideways due to FX

- Wholesale expected to decline high single-digit in 2026

- Saks bad debt accrual still uncertain

- ~10 China stores to close over medium term

Bottom Line: Zegna's Q4 results confirm the DTC pivot is working, with the flagship ZEGNA brand delivering meaningful acceleration. The leadership transition to Tagliabue signals continuity while the fourth-generation Zegna family members step up. However, investors need clarity on Saks exposure and sustainable China improvement before the valuation re-rates. Americas strength remains the key positive, but 2026 margin guidance of "sideways" suggests operating leverage remains elusive near-term.

Note: These are preliminary and unaudited revenue figures. Full FY 2025 financials will be released March 20, 2026.

Related: ZGN Company Profile | Q3 2025 Earnings | Latest Transcript